Working capital - simply explained - optimisation opportunities

If you study business at university, you will hear about profits, costs, expenses and cash flows again and again in accounting seminars. These are the variables on which one usually focuses. There is also information about optimisation measures, such as Six Sigma or Lean Management. From this perspective, one comes to the assumption that a company is only concerned with optimising processes in order to become faster and better. However, there is one factor that receives little attention, especially in small and medium-sized companies. Yet it plays a major role in the success of a company. We are talking about working capital. What is this key figure all about?

What is working capital?

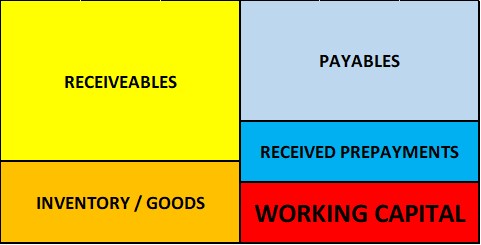

There are different versions of working capital. As a rule, it is calculated as follows:

current receivables - current liabilities = working capital

This is the difference between two balance sheet items. But there is an extended form:

current receivables + inventories + semi-finished goods - current liabilities - advance payments received = operating working capital

As you can see, it is about offsetting short-term items from both sides of a balance sheet. But not just any items, these are items that are very closely related to operations. Hence the term operating working capital.

The bottom line is that working capital is the difference that I have to finance with the help of liquidity in order for my business to function. And according to the logic of the balance sheet, you need capital for this in the form of equity or debt. No big deal.

But it only gets really complicated when you make comparisons with each other. For example, that other companies need significantly less WC for a similar turnover. That means they need fewer loans or less money from investors. And that is where the problem lies. Borrowed money always wants to earn interest. Equity investors want high returns. Banks charge interest, which is not always all that wild. However, there is often a credit limit from the bank. And if you want to expand at some point, you should not waste this limit on using working capital inefficiently. So what is the solution?

Optimise working capital - how does it work?

What are the reasons for high working capital ratios? It can easily be summarised: Everything that increases the asset side worsens the working capital ratio.

Receivables

The stock of open invoices to customers is the key here. Do not give generous payment terms. Make sure that defaulting payers get a call quickly. If they do not respond, then call in a company, such as the people for debt collection Hamburg. They recover such items quickly.

Stocks of materials and semi-finished products

Do not produce in stock, but keep all stocks low. This massively reduces the need for financing.

Payables

Clearly push the limits on invoices from suppliers. Pay on the last day of the deadline or perhaps a week later. This improves your working capital and if you miss a deadline by a short time, there is usually still no reminder.

Deposits received

If possible, ask customers for a deposit on large orders. This is common practice in most industries and also makes it easier for you to finance the business.